Why Every HR Problem Becomes a Sales Problem

Here’s a reality: half of your competitors hire better than the other half. Some are in the bottom 10%, and then there are those great companies in the top 10%. You can imagine how this variance impacts your bottom line, whether you have 5 or 5000 employees.

The same could be said for your retention practices. What if you had half the turnover of your closest competitor?

I speak with a lot of business owners. I do my best to help them understand there is a great opportunity in Great HR practices. I also let them know somebody must pay for poor HR practices and eventually that somebody is the sales team (which may be you).

There’s a lot of variance in the cost of that turnover depending on whether they were poor performers or great performers, took people with them, filed unemployment or work comp claims, etc. To get a true sense of this exposure, I encourage you to fill in your “replacement” costs:

- The time and money it takes to find a replacement. Sourcing, interviewing, referral fees, etc. If you are a small shop and doing the hiring yourself that cost adds up quickly (What’s a few hours of your time worth?) __________________

- Time and cost of background checks and pre-hire fit for duty exams. (You do both…right?) Typically $75- $100 per new hire, if you do it right. ______________

- Short -term replacements costs such as paying for overtime, hiring a temporary employee or best of all, doing the job yourself. _______________________

- The cost of customer dissatisfaction (they lost a contact they liked and trust, or you lost the customer because of that employee they never want to see again) and loss of “brand value.” (What’s the “lifetime” value of a customer? What’s the value of your brand?) _________________________

- Training, onboarding, new hire paperwork, payroll, benefits, handbook, etc. _________________________

- A poor player affects team productivity. (How many people do they typically work with on a team?) ________________________

- Poor employees generate safety and work comp costs. (The most dangerous employee is a new employee. ) ____________________________

- It affects unemployment payments __________________

- It affects overall morale, reducing engagement and “discretionary” effort. (What % of total payroll costs is affected? If it causes even a 5% dent that’s a huge number. ) ____________________________

- It drives you crazy and that is… priceless!

Let’s say the turnover cost is conservatively $5,000 per rank and file worker. The ratio jumps dramatically higher with office personnel. It is an expense that comes right out of ownership’s pocket. There’s no insurance for it, or any way to amortize the cost. Let’s say you lost three rank and file employees at $15/hr. and an office worker at $30/hr. That will cost you at least $75,000. To put that $75,000 back into ownership’s pocket, you must now produce a certain level of replacement revenue. Sometimes people are quick to think that’s an ROI figure, meaning if the company has a 10% ROI then it will cost $750,000 in revenue to place the $75,000 back into the pockets (bottom line).

Not so fast.

After speaking at two CPA conferences, I learned this was not the case. Because there are many fixed overheads involved, the replacement figure is closer to a 4:1 to 6:1 ratio. Meaning you must bring in top-line revenue of anywhere from $300,000 to $450,000 to put the $75,000 back into your pocket! And…that’s just so you can break-even!

Now that’s a much bigger problem!

It gets owners attention when they connect the dots and realize their personnel practices are not just creating cost problems but revenue problems too. That revenue can be broken down into the number of sales, customers, marketing efforts, engagements and other activities required to generate it. For example, if you’re earning $2,000-$4000 on each new contract sold you must sell at least 75-150 contracts to break even on losing those employees. What will you have to drive those additional sales?

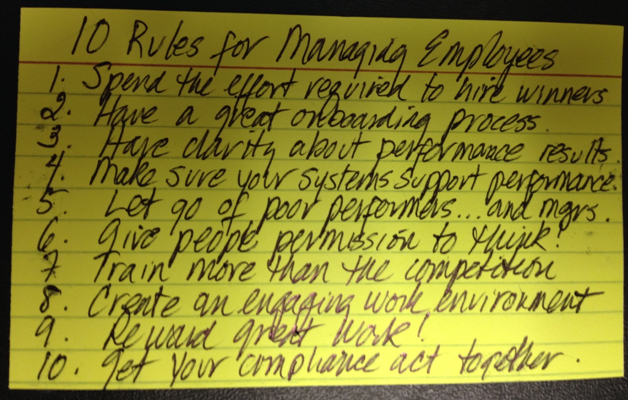

I’ll say it again…getting your HR act together is one of the most underutilized opportunities at most companies, and most likely yours. Everything I hear from owners is about getting talent, getting talent, getting talent. Is your HR dept. (even if it’s somebody wearing three hats, like you) helping to attract great employees? Do you have robust referral programs? Is there great onboarding and engagement practices?

In future articles, I’ll drive further into best practices you can consider…but it all starts with knowing the math.

Whether you are an owner reading this, in HR, or simply interested, I will send you an Excel doc where you can help quantify your Turnover Costs and another spreadsheet to help you determine the most cost-effective Retention Programs to use.

Here’s to growing your bottom line!

Don

(619) 852-4580